Production Location Options Are Now Global

“Once loyalty begins, it does not have an end. Otherwise, it would not be loyalty.” – Mariko, “Shogun,” FX Productions, 2024

A lot of people like to blame the six-month combined strikes as a big reason fewer films and TV series aren’t being greenlit in Hollywood and fewer industry pros at every level are working.

Wrong!

We’ll state the obvious.

People have been putting in way too many hours for too many days straight for too little pay, and minimal benefits for creating, producing films and shows for a long time–not just in Hollywood, but across the country and the industry.

A key part of the Hollywood content production cut back was highlighted by John Landgraf, FX Network’s chairman years ago when he coined the term Peak TV.

Back in the television heyday, there was a proliferation of large and diverse scripted shows; but as Landgraf projected, those days are gone as the TV industry enters the new era of budget management in the face of diminishing pay TV subscriptions.

You could blame the dwindling pay TV audience on the rapidly increased interest in streaming anytime, anywhere, any screen entertainment.

Netflix and Amazon Prime certainly encouraged people to change their viewing habits but the studios/networks (Disney, WBD, Paramount, Peacock and their network subsidiaries) saw where home/personal entertainment was going and wanted to retain – and increase – their audiences.

But Landgraf also noted that the TV industry was simply producing an unsustainable glut of content that was exceeding consumers’ entertainment demands and budgets.

Production shut down simply gave them the time and opportunity to reevaluate their focus, direction, content priorities and budgets.

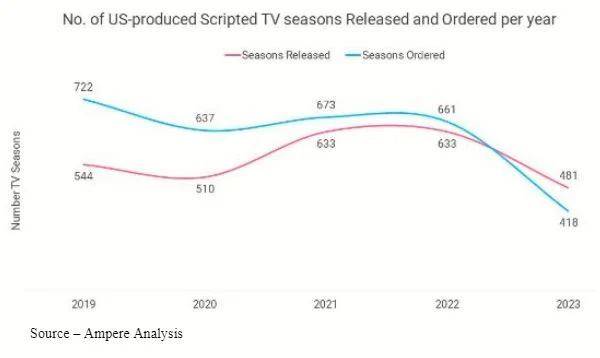

Scripted series dropped from commissioning 600 series in 2022 down to 516 last year.

This year, an estimated 490 scripted series were ordered – with abbreviated seasons – as network TV shifted their show/content orders to cheaper, less complicated game, reality and unscripted shows.

In other words, the end of Peak TV probably spells the end of Peak TV employment.

Another part of the problem is that Hollywood/LA believed its own publicity that the area is the absolute mecca of video content creation/production.

Production has been leaving the area for years for places like Georgia, Texas, NYC, Toronto, Britain, Australia, Nigeria, Mumbai, Brazil, South Korea, Berlin and other places around the globe.

Suddenly, studios and streamers had options.

New, ultra-modern studios have been built everywhere.

Location Options – New studios and the supporting service operations are cropping up around the globe as locations bid to be the greenlight location of choice including such locations as Tyler Perry Studios in Atlanta and Hertswood Studios in England.

You know, like Tyler Perry’s sprawling and expanding studios near Atlanta or Hertsmere’s expansive facilities in England and modern content creation centers just about everywhere.

All of the studios are built with multiple virtual production capabilities that enable creatives to duplicate any location and environment on and off the planet to eliminate or minimize location shoots.

VP – All of the new film/show studios include at least one large and one small virtual production facility that enable content owners to quickly create (and recreate) locations found anywhere around the world and beyond as well as any time period – past, present and future.

All of these content-bidding centers also have the latest cameras, technologies and a growing pool of production people schooled in advanced production techniques that are available to the project owners.

Postproduction has never been an issue because most of this creative work/magic is already done remotely and globally with projects moving seamlessly across the internet from one specialist to another, regardless of where he/she is located.

Incentives – Cities, states, regions and countries are all expanding their incentive programs and capabilities to make it faster, easier and financially rewarding to create/produce films/shows around the world.

Cities, states and countries have increased their financial and tax incentives. They’ve also beefed up and expanded their financial, tax incentive and cash rebate programs 20-40 percent to produce/co-produce projects in their areas.

They’ve also modified and streamlined their production and location shooting coordination assistance to make it not only more economic but also easier to work on projects in the area.

Many of the areas have set up their own educational facilities to train people in the type of work that is needed in film/show production and support activities.

A good base of crew, labor and production facilities plus incentives can be very persuasive.

As a result, there has been a growing interest in filming locations not just in Georgia, New Mexico, New York and Louisiana but also in Canada, the UK, Australia and other locations around the globe that have invested heavily in the creative project infrastructure as well as crew training. This assistance has resulted in a rash of major films like Anyone But You, The Fall Guy, Bob Marley: One Love, The Ice Road 2: Road to the Sky, Kingdom of the Planet of the Apes, The Surfer and Furiosa: A Mad Max Saga being produced in English-friendly countries.

Necessary Move – To increase its global subscription numbers, Netflix also had to expand its video libraries to include a specific percentage of films/shows that were produced in the country.

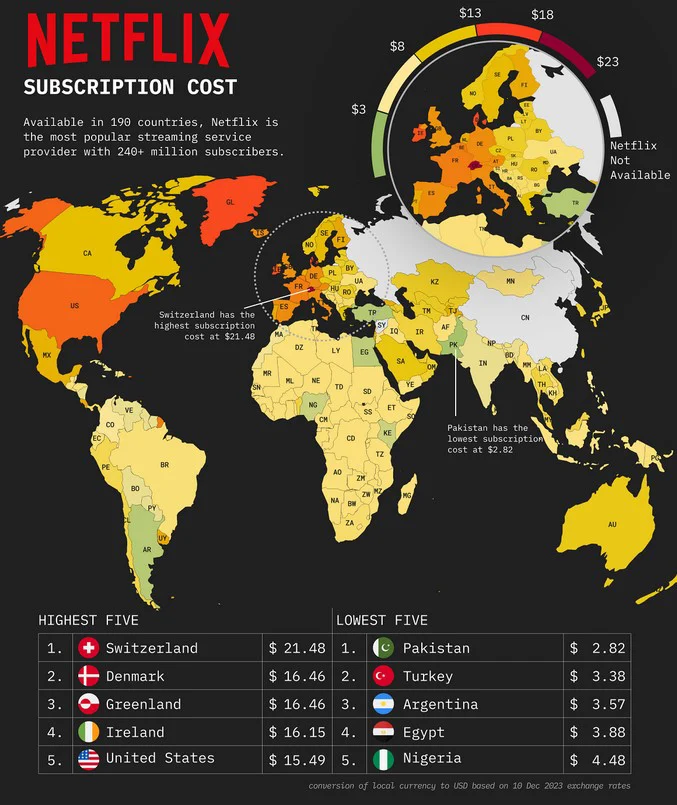

Yes, global streamers like Netflix, which is available in 190 countries and has nearly 280M subscribers, according to the latest earnings report, has taken advantage of the globalization of content production.

But it initially began as a requirement for the company to offer and stream entertainment to local subscribers

Because every nation requires that 30-40 percent must be local.

With a lower cost of production combined with the quality of the entertainment, the local requirements quickly proved to be a benefit, not a limitation.

Home folks liked the video content, and it turned out people in neighboring countries also enjoyed it.

The real boon came when Netflix – and the other streamers – realized that good entertainment isn’t limited by borders.

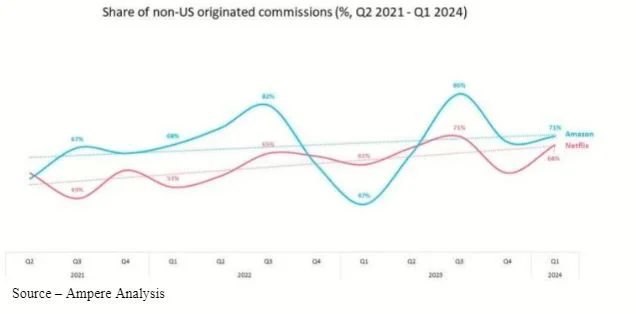

Variety – The development/production of projects outside the US has grown for both Netflix and Amazon Prime as they find people are attracted to good/great content no matter where it is produced.

The realization came at just the right time for Netflix and Amazon Prime, the two global content streamers that were making more creative video story investments around the world because international producers weren’t bound by the US union guidelines which had ready access to local government subsidies and tax credits.

It was an opportunity for them to come onto their own on the world stage and fill the production gap. They not only became a good substitute for US productions, they became sought after non-American movies and shows people wanted to see, enjoy.

Films like The African Queen, Parasite and RRR enjoyed strong audience attention when they were released in their respective home countries – Uganda, Korea, India – as well as viewership around the globe.

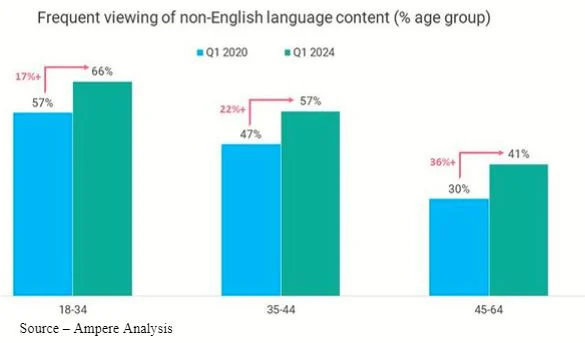

Shifting Taste – It’s probably somewhat logical that younger audiences would be the first to enjoy international movies/shows but it hasn’t taken older generations long to appreciate great video stories no matter where they are created/produced. According to Ampere Analysis, 54 percent of streaming users ages 18-64 in the English-speaking centers of the US, Australia, UK and Canada watched non-English-language shows and movies very often.

As would be expected, 66 percent of younger folks (18-34) regularly watch international content but middle-aged adults 45-64 years of age (30-41 percent) quickly adopted the new content.

Netflix was perhaps the first to enjoy global attention to the newly found interest thanks first to Squid Game and a series of new, interesting projects from Southeast Asia.

This was closely followed by several audience-winning anime projects from Japan.

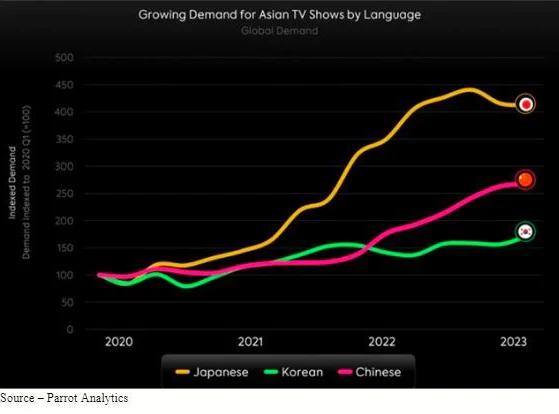

Asian Influence – Thanks to the exposure of excellent storylines and production films, shows from Japan, Korea and China have quickly found receptive audiences throughout the streaming world.

Viewer demand for Asian movies/shows continues to grow but so does the interest in projects created from the ground up in other countries.

Streamers have increased their European film and show investment more than 50 percent to nearly $6B last year as well as $2B in Southeast Asia. There’s also growing interest in African projects and production capabilities.

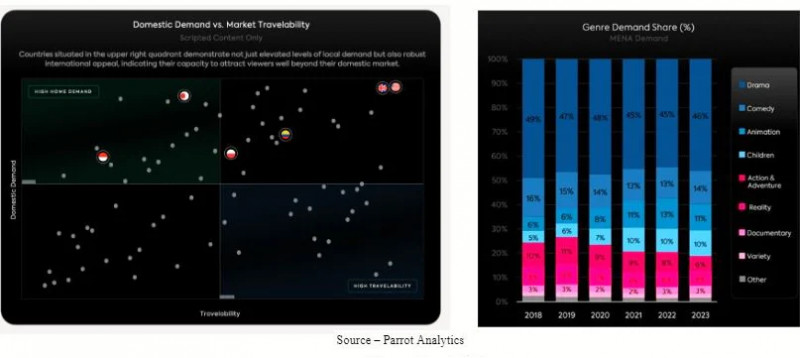

While it might appear to be everything, everywhere, all at once for the $345B online video industry, that’s not necessarily true because films and shows created from the ground up from certain countries tend to travel across borders better than others.

Prospective Entertainment – While studios and streamers first thought all of the growth and profits would come because people in other markets would be hungry for content developed in the Americas, it has become financially obvious that films/shows created in other markets were equally in demand. At the same time, genre interest varies from country to country.

Films and shows from certain countries tend to have strong local demand in addition to garnering strong international interest.

And as always, specific genre has strong appeal to varying population groups regardless of their point of creation.

Shows and movies that balance local storylines with universal themes tend to resonate well across a broad range of cultures and languages.

In other words, streaming is encouraging and accelerating a global trend to more inclusive and diverse content.

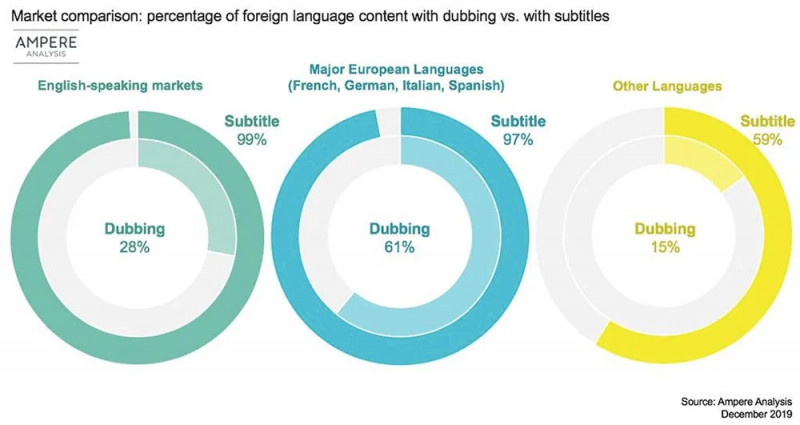

Obviously, this has led to a growing demand for fast, reliable and economic content localization – subtitles, closed captions (increasingly demanded to assist the hearing impaired) and dialogue dubbing.

Verified Market Research has forecast that the global film dubbing market will be worth more than $3.5B in a couple of years and global translation will be worth in excess of $47B by 203l, largely driven by the entertainment industry.

“There are pros and cons to both localization approaches,” Allan McLennan, past president of 2G Digital Post in Burbank/Hollywood now CEO of PADEM Media Group, noted.

Localization – The preference for or resistance to watching a film/show that has been subbed or dubbed varies widely on the country it is being shown in and the age of the audience.

He explained that subtitles preserve the original audio (something we enjoy even though we may not always understand what is being said), doesn’t need precise lip sync and is about 10x faster and less expensive than dubbing. At the same time, it takes control of the lower three inches of the screen, harder for children and requires the viewer to pay closer attention to the words and images but does extend the reach to greater audiences.

As for dubbing, he said there is obviously no need then to read, which assists children. Closer attention now has to be paid to lip movements during postproduction that makes the audience feel “more connected.” It’s the traditional way of dubbing but a bit more expensive.

“The industry has gone through a major transformation as people have increased their interest in content from other countries, other cultures,” he emphasized. “Initially, it was focused on broadening the reach and sales of US films/shows in other countries but now people want to experience and enjoy projects created in Pakistan, China, Saudi Arabia, Poland, Columbia, Mexico and all of the other countries in the world in their own living rooms.

“Thanks to the use of advanced/economic automation, AI and machine-learning tools translation, voice synthesis and voice cloning and human quality control can significantly reduce costs (time and money) and deliver almost flawless films and shows for the studios and streamers,” he added.“But obviously, many of the project owners prefer dubbing because the retainment overall of the video story is perceived to be better,” he commented. “In addition, and more importantly, the viewing public has come to like the international experience of the show/movie in the native language and following the subtitles has become a part of the total project viewing experience.”

While localization has become a standard part of the project for studios and subscription streaming services, there has been an increase in its use of ad-supported streaming services.

For example, FAST services like Pluto and Tubi have been increasing their acquisition of films/shows from outside the Americas and making them available to their growing viewer bases and monetizes their ad-based services.

Studios, streamers and everyone in the content development, production and delivery industries are finding that globalization of shows/movies enables them to entertain people everywhere and; more importantly, increases the quality, value and self-worth of their chosen profession.

Or as Toranaga reminded us in Shogun, “You are playing a game of friends and enemies, when you have only yourself in this life.”